9 in 10 U.S. workers struggle with basic needs

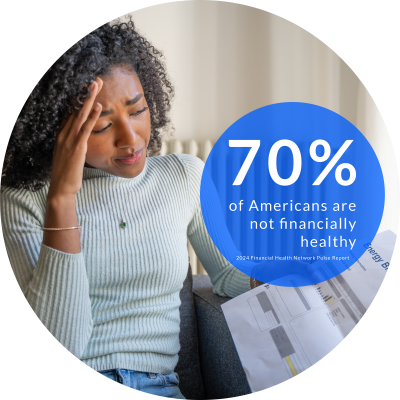

With just 30% of Americans considered financially healthy, financial illness is the biggest unaddressed employee cost today for employers with frontline workforces. It adds 30% to healthcare costs, as the largest social determinant of health.

When you help financially ill employees, you’ll lower healthcare costs, improve retention and productivity, and see more impact from your investments in other benefits. But you’ll only see those results with Brightside Financial Care.

Sources: WTW 2024 Global Benefits Attitudes Survey, Financial Health Network

Financial wellness isn’t meant for daily financial struggles

Financially ill employees struggle with basic costs such as food, healthcare, housing, and transportation. They have urgent needs and face complex challenges that cannot be solved by CFP-led financial planning or one-size-fits-all financial education.

Financially ill employees need real solutions from someone on their side, who won’t judge their situation and won’t make money from their choices. That’s Financial Care.

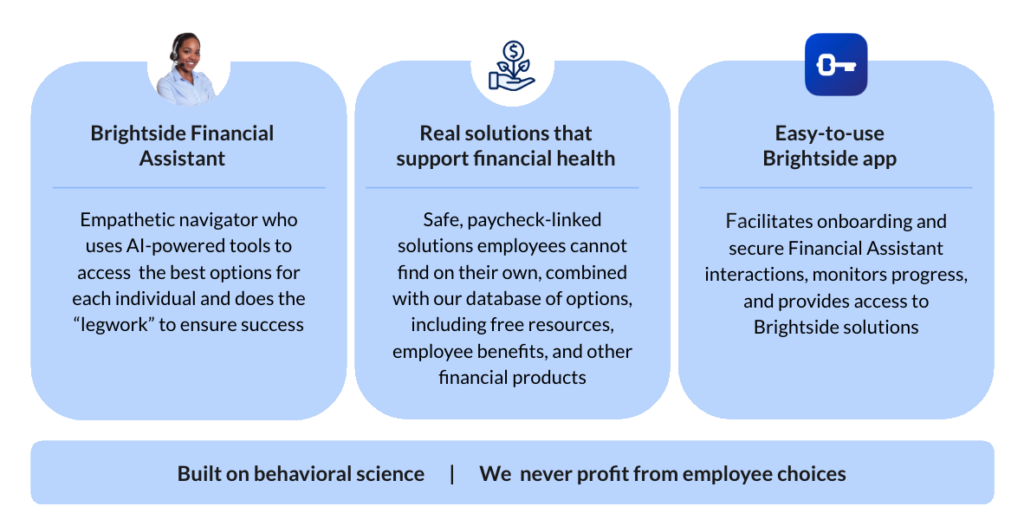

Treating financial illness with Financial Care requires these critical elements

Brightside Financial Care is a complete financial health platform for employers, employees, and their families.

Why employers love Financial Care

Enhanced employee experience – Help employees navigate and use other benefits. Users rank Brightside a 90 + NPS score, on average.

Employees show up as their best selves – Proven improvement of retention, productivity, absenteeism, and safety metrics.

Give employees the support they want – Employees value financial wellbeing support over all other wellbeing benefits . This is the #1 misalignment in employees’ benefit wants vs those employers offer.

A complete and safe solution – No need to implement and integrate point solutions from companies that make money off of your employees.