Why Helping Frontline Employees Navigate Tax Season Matters

Tax season can provide a financial lifeline to lower-income employees who qualify for valuable tax credits that may lead to a tax refund – but the IRS reports that 1 in 5 miss out on thousands of dollars each year. Employers that think beyond traditional financial wellness approaches and provide comprehensive financial benefits that include […]

What 12 Years of Data Reveal About Employee Financial Health

The FINRA Foundation’s National Financial Capability Study (NFCS) has tracked financial wellbeing in the U.S. since 2009, providing valuable insights into how Americans manage their money, their financial knowledge, and their ability to handle financial shocks. After more than a decade of data collection, these key trends have emerged — many of which have implications […]

Supporting Employees Through Crisis: How Brightside Makes a Difference

Natural disasters and unforeseen crises, like the ongoing California wildfires, leave employees facing immense uncertainty. Beyond the physical and emotional toll, many impacted employees find themselves navigating urgent financial needs, such as lost wages, unexpected major expenses, and how to replace lost and critical resources including housing and transportation. For HR leaders, these moments can […]

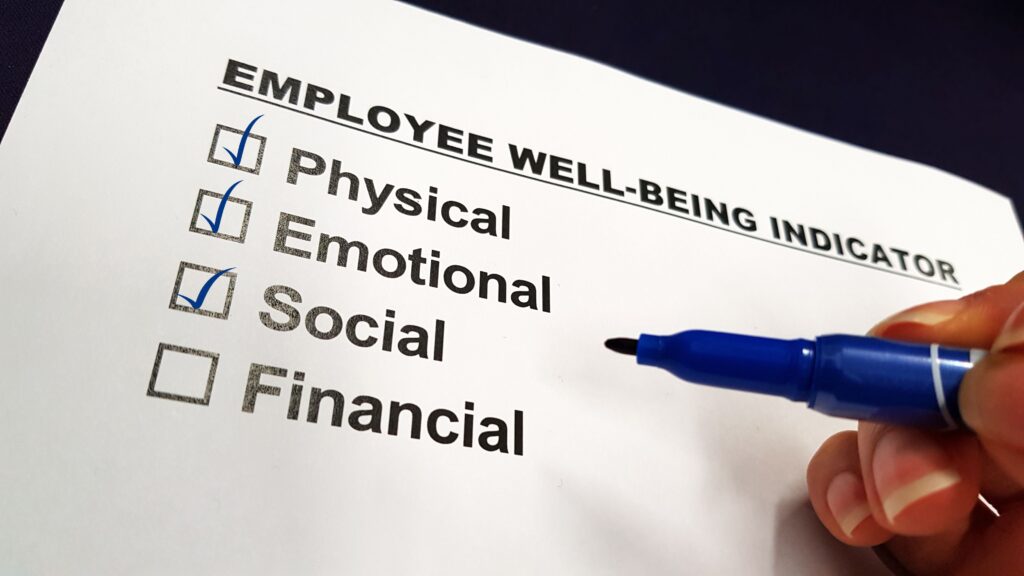

Why Financial Illness is a Business Problem Employers Can’t Ignore

Employee financial health is in crisis—and it’s a business problem that costs companies more than they may realize. A WTW study revealed that poor employee financial health costs large employers $3,000 to $4,000 per employee each year. While physical and mental wellbeing programs have grown in popularity, poor financial health remains the most overlooked dimension […]

How Employers Can Offer Safe Employee Loans That Protect Financial Health

When money emergencies strike, employees often feel forced to take out loans as a quick fix. With 70% of Americans considered financially unhealthy—struggling with low credit scores, debt, and little to no savings—many turn to high-interest payday loans, predatory lenders, or even their 401(k) to get by. These options worsen employees’ financial stress and ultimately […]

5 Reasons Workplace Emergency Savings Accounts Won’t Improve Employee Financial Health

Realizing that financial wellness solutions such as financial education, coaching, and planning are not moving the needle on employee financial health, some employers are now considering different approaches. As a result, workplace emergency savings accounts (ESAs) are a type of employee benefit that has increased in popularity. While having liquid savings is an important component […]

The Growing Financial Strain on Employees: Insights from the 2024 Financial Health Pulse® Report

The financial health of working Americans has become alarmingly fragile, based on new findings in the Financial Health Network’s Financial Health Pulse® 2024 U.S. Trends Report. More than two-thirds of households (70%) are financially unhealthy, and day-to-day financial health indicators—such as short-term savings, debt manageability, spending relative to income, and the ability to pay bills on […]

How to Lower Your Healthcare Costs By Helping Financially Sick Employees

If you’re like most benefits leaders who responded to Aon’s 2024 Health Survey, your top priority in 2024 has been managing healthcare costs, followed by investing in benefits that attract and retain employees, and support workforce health and wellbeing. Despite the inherent difficulty in that balancing act, it will soon become more challenging. Over the next […]

The Missing Piece in Wellbeing Benefits: Treatment for Financial Illness

Benefits leaders invest so much time, energy, and resources into selecting wellbeing benefits that help employees thrive, personally and professionally. Yet, more than 70% of employees are living paycheck to paycheck, and Americans are struggling with record levels of household debt. This means that many employees and, by extension, their employers, are facing a crisis […]

Why It’s in Your Best Financial Interest to Help Employees Manage Debt

Employers, your employees carry record levels of household debt -and it directly impacts your business. The majority of Americans now call finances their biggest source of stress. The proportion of people who call their debt unmanageable has increased from 38% to 42%, in the past year alone. Credit card debt is the highest it’s been since 2003, and serious […]