Why Helping Employees Navigate Tax Season Matters

Tax season can provide a financial lifeline to lower-income employees who qualify for valuable tax credits that may lead to a tax refund – but the IRS reports that 1 in 5 miss out on thousands of dollars each year. Employers that think beyond traditional financial wellness approaches and provide comprehensive financial benefits that include […]

How Student Loan Policy Shifts Are Fueling Financial Stress in Your Workforce

The student loan landscape has shifted dramatically over the past several months. It has become a confusing maze for anyone to navigate alone, and the financial impact is widespread. Student loan changes can influence how borrowers manage basic living expenses, other types of debt, everyday money problems, and whether they can save for emergencies, participate […]

Millions of Workers Are Losing Health Coverage. Employers Can’t Ignore It.

As of January 1, 2026, enhanced federal subsidies that made Affordable Care Act (ACA) Marketplace plans more affordable for nearly 20 million Americans have expired, resulting in significantly higher premiums for many workers who rely on individual coverage. While the Senate is set to vote on a bill that could extend the subsidies, Newsweek reports […]

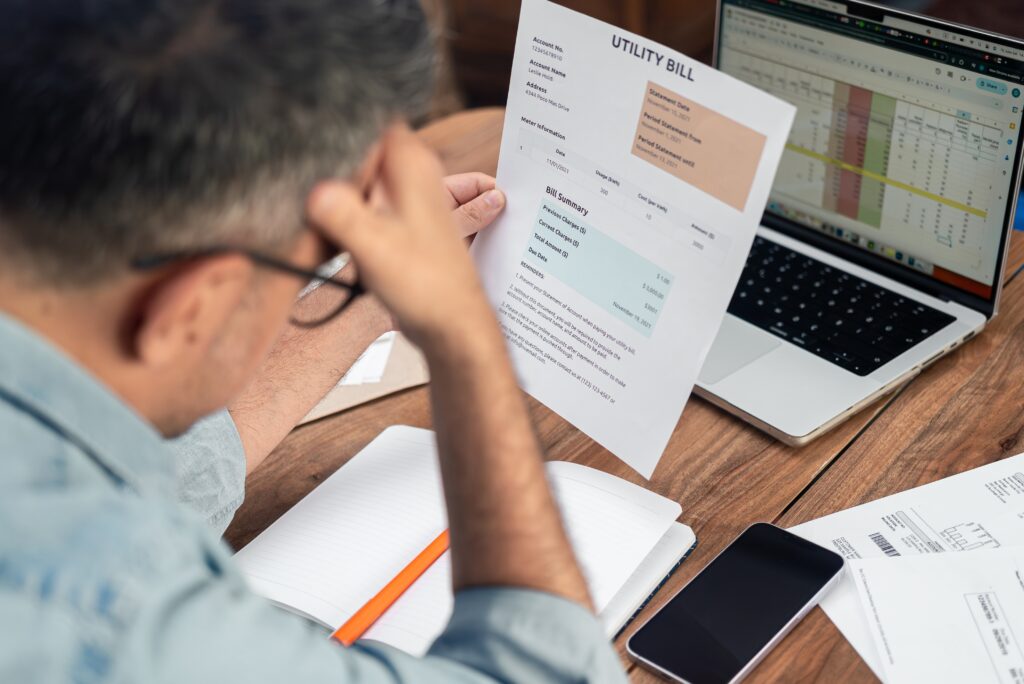

Why Rising Utility Costs Are a Red Flag for Employers

As winter nears, rising utility costs are pushing millions of working families to a financial breaking point. Past-due utility balances rose nearly 10% year over year, according to Politico Nearly 6 million households will soon have utility debt reported to collections Heating costs could rise by as much as 20% this winter, according to the National Energy […]

Still Struggling: What the 2025 Financial Health Pulse® Report Reveals About Employees

The financial health of working Americans remains fragile, according to the Financial Health Network’s Financial Health Pulse® 2025 U.S. Trends Report. Last year’s report painted a troubling picture, with more than two-thirds of households (70%) considered not financially healthy and day-to-day indicators trending downward. The 2025 findings show only slight improvement: just 31% of households […]

How Financial Stress Is Driving Benefits Choices

“What does the price of eggs have to do with annual enrollment?” Mercer asked that question recently, and the answer is: more than you might think. With 70% of employees considered not financially healthy, many of your employees are currently struggling with the cost of housing, groceries, and everyday essentials. As open enrollment season approaches, […]

The Healthcare Cost Crisis is Growing – But Employers Aren’t Powerless

U.S. employers started this year expecting their healthcare costs to jump 8% — the highest increase in more than a decade, according to the Business Group on Health (BGH). Unfortunately, that expectation became reality. Even more concerning, BGH’s president and CEO said they don’t “anticipate trend abatement for 2026.” It’s no wonder that WTW’s 2025 […]

Health Equity and Financial Health: The Link Employers Can’t Ignore

Many employers have made bold commitments to health equity in recent years, investing in mental health, addressing social determinants of health (SDOH), and building more inclusive benefits packages. In fact, Brown & Brown estimates that 95% of employers have adopted at least one strategy to improve health equity among diverse employee populations. Yet one key […]

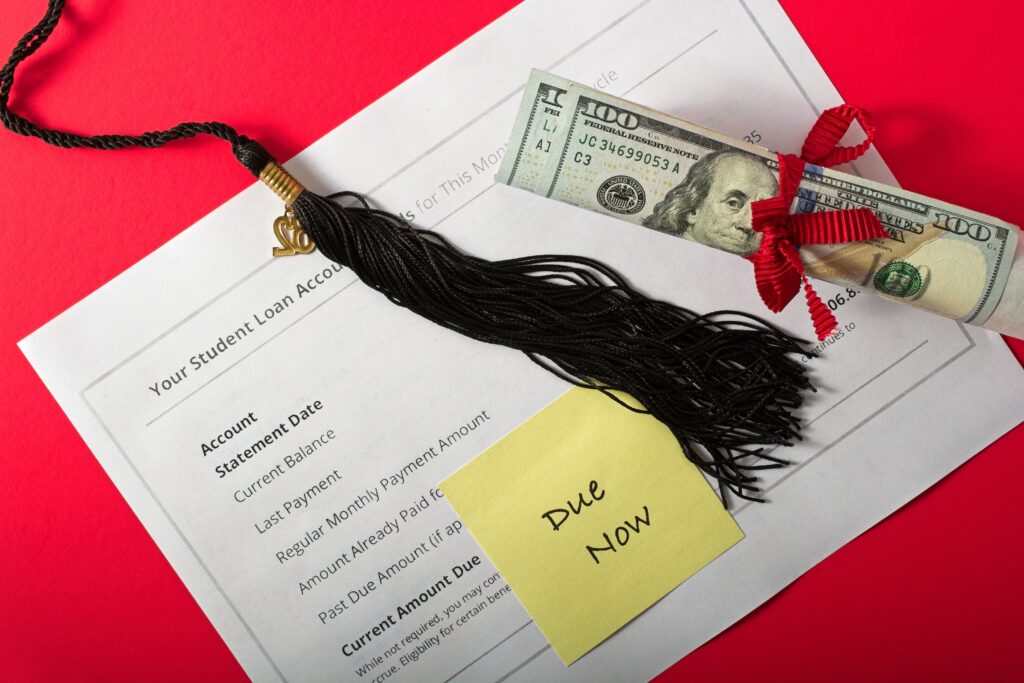

Why Student Loan Support Can’t Wait — And How Brightside Makes It Count

For years, student loans were paused. Conversations around them went quiet. But now that repayments resumed — and student loan collections have restarted — the financial impact of student loans is hitting employees and their employers hard. Not only have shifting policies left more than 43 million Americans who owe over $1.6 trillion in student […]

Why Financial Care is Critical to 401(k) Savings Success

In 2022, Americans’ financial health declined for the first time in five years. Between 2023 and 2024, several key financial health indicators got even worse. Today, 70% of Americans are considered financially unhealthy and seven out of 10 Americans are living paycheck to paycheck. Despite that the 2024 Employee Benefits Research Institute (EBRI) Survey revealed […]